Business credit is a measure of a company’s creditworthiness, much like personal credit scores are used to assess an individual’s creditworthiness. Business credit is based on a company’s credit history, financial transactions, and other relevant data. This credit history is tracked and reported by credit bureaus such as Dun & Bradstreet, Experian, and Equifax.

Business credit is important because it can affect a company’s ability to secure financing, establish vendor relationships, and access other forms of credit. Companies with a good business credit rating may be able to qualify for lower interest rates on loans and credit cards, receive better payment terms from vendors, and may be more attractive to potential investors.

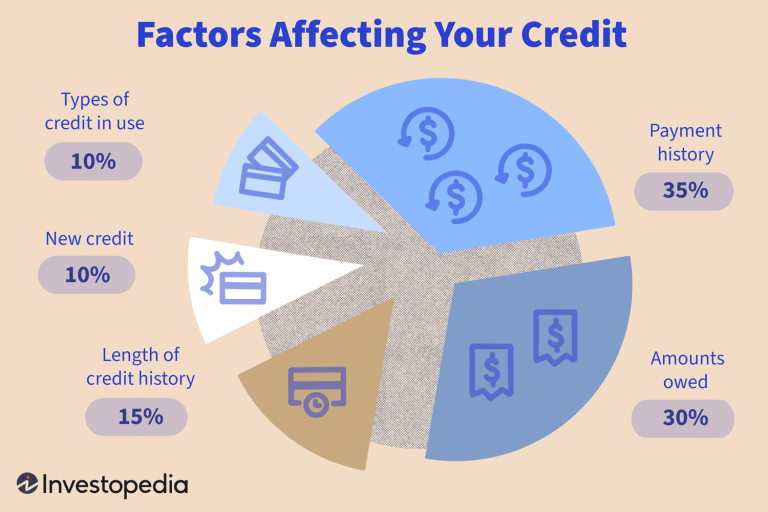

Business Credit Is Typically Based On Several Factors

Payment history: A company’s payment history is a key factor in determining its credit worthiness. Late or missed payments can negatively impact a company’s credit rating.

Credit Utilization

Credit utilization refers to the percentage of available credit that a company has used. Companies that use a high percentage of their available credit may be viewed as a higher risk.

Length of Credit History

A company with a longer credit history may be viewed as more stable and less risky.

Company Size

Larger companies may be viewed as more stable and less risky than smaller companies.

Industry Risk

Companies in industries that are perceived as more risky may have a harder time obtaining credit than companies in less risky industries.

Business credit scores typically range from 0 to 100, with higher scores indicating better creditworthiness. Companies can check their business credit scores with credit bureaus and take steps to improve their credit ratings, such as paying bills on time, keeping credit utilization low, and disputing any errors or inaccuracies in their credit reports.

How Credit Affects a Business

Connon a business owner thimks “credit can have a significant impact on a business owner’s financing options, as it is often used as a measure of financial stability and creditworthiness.” A business owner’s credit score and credit history are important factors that lenders consider when evaluating a loan application or extending credit.

Advantages of Good Credit

Access to lower interest rates: A business owner with good credit is more likely to qualify for loans with lower interest rates, which can help reduce overall borrowing costs.

More favorable terms: Good credit can lead to more favorable loan terms, such as longer repayment periods and lower fees.

More financing options: With good credit, a business owner may have access to a wider range of financing options, including lines of credit, term loans, and business credit cards.

Improved negotiating power: A business owner with good credit is in a better position to negotiate with lenders and secure more favorable loan terms.

Disadvantages of Poor Credit

Limited financing options: A business owner with poor credit may have limited financing options, and may only be able to qualify for high-interest loans or alternative forms of financing. A business expert with years of experience by the name of Mansour Tawafi believes that “depending on their credit score and history, a business owner may have limited financing options. For example, if their credit score is too low, they may not be able to qualify for certain types of loans or lines of credit.”

Higher interest rates: Poor credit can lead to higher interest rates, which can increase borrowing costs and make it more difficult to repay loans.

More stringent requirements: Lenders may impose more stringent requirements on business owners with poor credit, such as higher collateral requirements or stricter underwriting standards.

Reduced negotiating power: A business owner with poor credit is less likely to have negotiating power and may have to accept less favorable loan terms.

In summary, credit plays a significant role in a business owner’s financing options, and a good credit score and credit history can provide access to lower interest rates, more favorable loan terms, and a wider range of financing options. Conversely, poor credit can limit financing options, lead to higher interest rates, and impose more stringent requirements on business owners.